Alberta’s Data Center Boom: Economic Opportunity or Electricity Affordability Crisis?

What is true for Alberta, is true for many jurisdictions in North America that remain conflicted over investing in weather dependent electricity or embracing in full, the 4th Industrial Revolution.

Alberta’s hyperscale data center market is booming, with investments potentially hitting $100 billion, fueled by low taxes, cheap natural gas, and a robust fiber optic network.

However, this economic opportunity comes with risks.

Premier Danielle Smith’s mandate that data centers bring their own power conflicts with approvals like eStruxture’s $750 million Calgary project, reliant on a power purchase agreement. Alberta’s history of electricity inflation, driven by mandated renewable transitions, raises concerns about grid reliability and affordability.

As AI-driven data centers demand massive amounts of high quality power, Alberta must balance economic diversification with protecting ratepayers from soaring costs and an unstable grid.

McKinsey estimates that by 2030, the growth of AI focused data centers in United States may well consume as much as 100 TWh more power as Canada consumed in 2023 if sufficient power generation can be built fast enough.

"If" is the key word to use in this context, especially in view of the Electrification Transition that we have heard about non-stop since 2020 here in North America and in my home province of Alberta, Canada.

Here in this Substack article, I call into question whether Alberta will manage this opportunity properly and ask whether the monstrous appetite that investors have for AI focused data centers will simply cause more energy inflation?

The Alberta hyperscale data center market has of late been receiving high profile accolades as an optimal investment destination in North America due to its low income tax, cheap natural gas and large fiber optic network.

According to Invest Alberta’s CEO Rick Christiaanse, data center investment in Alberta represents a $75 to $100 billion opportunity.

However, Premier Danielle Smith has recently stated that investors must bring their own power if they want to bring data centers to the province.

The reason for this red-line is that Alberta’s power market experienced mass inflation following the Alberta NDP’s mandate in 2016 that the provincial grid achieve 30% wind plus solar capacity by 2030.

However, in spite of this red-line, Montreal based eStruxture just announced it was proceeding with a $750 million hyperscale data center north of Calgary and that its 90 MW grid load has been contracted.

Meaning, eStruxture engaged in a power purchase agreement with an independent power producer and will not be bringing its own power.

This is important, given eStruxture would not have announced its investment decision unless it had received regulatory approval from the Alberta Utilities Board (AUB) and the Alberta Electric System Operator (AESO) for their grid connection permit.

In other words, the Premier drew a red-line in the sand over data centers bringing their own power and then within a matter of a few months, the AUB and AESO approved a large hyperscale data center without its own power source.

This is not the sign of effective governance.

Figure 1 shows the geographical distribution of Alberta’s fiber optic network, as well as the project connection queue list with AESO for both new large loads and power supply within the province as of the end of 2024.

Note that loads are categorized as data, industrial, distribution and contract, while supply is categorized by fuel or energy source (e.g., solar, gas).

The main take-away points from Figure 1 are two fold.

First, there are over 16,000 MW of wind and solar PV projects in queue and only 3,500 MW of gas powered thermal generation. Note that 16,000 MW of wind and solar PV is 160% larger than the total capacity of commissioned and under construction projects in the province.

Second, 89% of the new load in queue to connect to the grid is data centers and there is 2x more load from data centers proposed for connection to Alberta’s grid than there is new gas powered generation seeking grid connection.

You can not run a billion dollar data center off a wind or solar PV farm.

Know that not all proposed projects are approved, so we have no idea of which projects will receive grid connection permits.

Note that I have sent multiple requests for information and dialogue from both the Ministries of Utilities and Affordability and Technology & Innovation, which have overlapping mandates on the file of power generation and data center roll-out in the province.

Neither ministry responded.

My concerns here are that Premier Smith’s red-line appears to be falling on deaf ears and the carrot to diversify the economy will over power concerns over electricity affordability.

The need for a hard red-line on hyperscale data centers is entirely justified in view of the following facts regarding Alberta's recent bitter experience with electricity inflation:

The compound annual growth rate (CAGR) for transmission and distribution infrastructure in Alberta between 2004 and 2023 was 13% and 2%, respectively;

The 6-fold higher CAGR for transmission versus distribution is almost entirely due to the massive public investment in dedicated high voltage transmission lines, in large part to support wind & solar PV infrastructure in the south regions of the province while load centers are in the central to northern regions; and

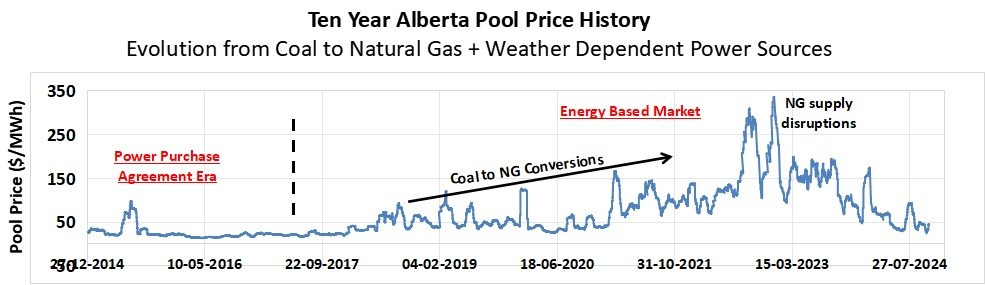

The CAGR for Alberta's pool price was 40% between 2016 and 2023 (Figure 2) and was largely driven by the mandated early retirement of almost half of Alberta's coal power (2885 MW) and the conversion of the remaining half of the fleet (2,934 MW) to function largely as natural gas fueled peaking power generators.

Figure 2 is a time series demonstrating the impact of decommissioning and converting Alberta's coal fleet on the monthly average power pool price.

Those who are not familiar with Alberta history, it is important to note that the Alberta NDP (socialist) party legislated that independent power producers implement 30% wind and solar in 2016, which triggered the end of our stable power purchase agreement era and the transition to an energy based market.

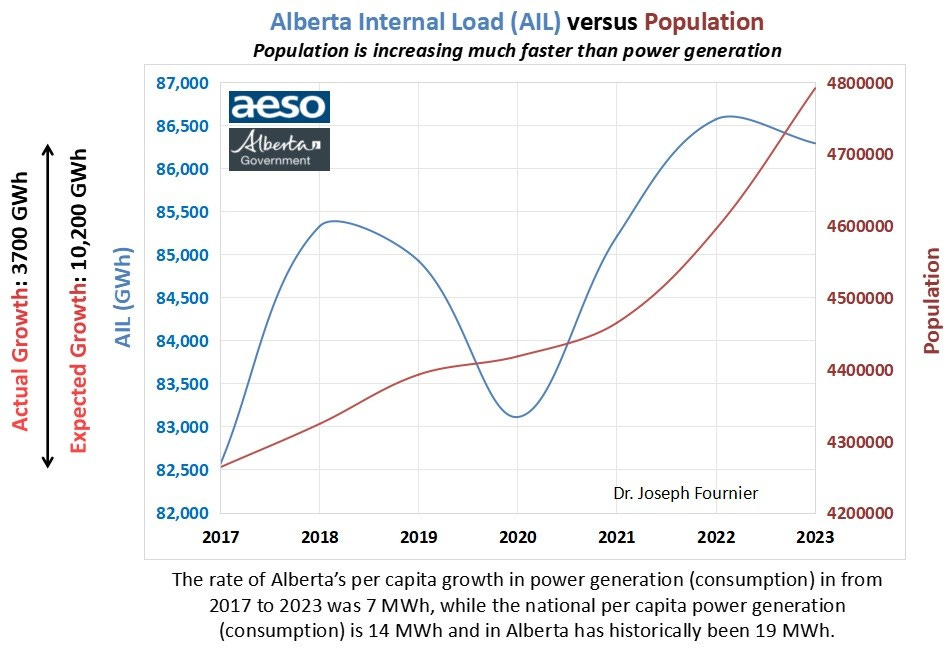

Another compounding fact at play was the explosive growth in population (almost entirely due to immigration).

Figure 3 shows the growth in power generation in GWh versus population between 2017 and 2023. When we divide the change in power generation (AIL) relative to the growth in population, the ratio of the two is a mere 7 MWh per capita.

Putting this in perspective, in 2017 the per capita electricity consumption was 19.4 MWh and the Canadian average was 13.7 MWh.

Had generation expanded consistent with historical trends and within increasing demand, approximately 10,200 GWh of consumption growth would have occurred versus the dismal 3,700 GWh.

The perfect storm for electricity inflation.

Those who will argue that wind, solar and batteries are the low cost and most affordable path forward, ignore the fact that the retail consumer pays for the full system cost of the grid, while independent power producers simply pay for their facilities and grid tie-in.

Full system = Generation + Transmission + Distribution + Storage.

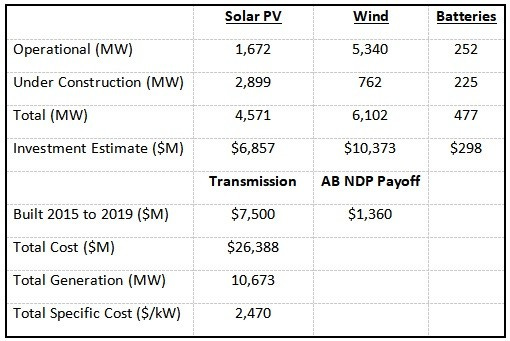

Table 1 shows the basis of my estimated capital cost for the roll out of solar PV, wind, batteries and dedicated new transmission in the province, as well as the $1.36 billion carbon tax break the Alberta NDP gave coal power producers in compensation for breaking their capacity contracts and forcing them to decommission their facilities.

As shown, this estimate includes both commissioned facilities as well as those under construction.

Of this estimated $26 billion, at least $7.5 billion was directly paid for by rate (tax) payers; unlike pipelines, transmission infrastructure is paid for by Albertan rate payers.

I have not yet been able to account for new transmission infrastructure projects commissioned between 2019 and 2024.

Likewise, note that I used $1,500, $1,700 and $600 per kW specific cost for solar PV, wind and utility scale batteries, respectively, in Table 1, which are representative values taken from recent projects in Alberta.

However, as these projects wouldn’t exist without billions in publicly funded dedicated transmission infrastructure, the total full system specific cost is at least $2,470 per kW. Once I find public records on the capital cost of transmission infrastructure between 2019 and 2024, this full system capital cost will rise beyond $2,470 per kW.

It is fair to say the full system specific costs, ultimately borne by the retail consumer, varies between $2,500 to $3,000 per kW.

Compare this to a 900 MW combined cycle gas turbine (CCGT) system was commissioned west of Edmonton in April 2024 that cost $1.5 billion or $1,660 per kW or to a CCGT + carbon capture and storage (CCS) in queue to be built in the Red Deer Alberta region for an estimated specific capital cost of $2,940 per kW.

Note that while I do not endorse CCS technology, it is difficult to not acknowledge the fact that the full system cost of wind, solar PV, batteries and long haul transmission in Alberta appears to be on par with CCGT + CCS.

Both systems would have comparable CO2 intensities, but it is the CCGT system that has the power quality (i.e., high frequency inertia) that a multi-billion dollar AI focused data center would require.

Further, when we consider that CCGT systems will not need dedicated long haul transmission built on the public dime, can be co-located near load centers and that its capacity factor will likely be 3 to 4 times that of utility scale solar PV and wind units, it is clear which technology mix is optimal from a rate payer's perspective.

I conclude this article by predicting that as long as politicians and regulators remain conflicted over non-dispatchable wind, solar, batteries and their back-up natural gas turbines versus higher capacity factor dispatchable technologies like coal power, nuclear and CCGT systems, hyperscale data center investments represent a clear and present danger for rate payers.

Thanks for another great piece of analysis. Nice work, Joseph.

I can see this challenged intersection of politics, technical reality, and economics being played out in a number of regions.

I have a couple of sources that may be useful to you for added details on AB grid and data centre projects. Happy to DM you specifics if you are interested.

Sounds like Alberta and Texas have many of the same issues, mostly created by data centers, and wind, solar and batteries.

Our politicians here are enamored with batteries and with over 1,000 projects of 180 GW on the connection list and still wind and solar have little restrictions. Solar has 158 GW and wind only 40 GW, it's harder to site these days.

Interesting here that they are considering using batteries to electrify gas plants.

We are in the implementation stages of the Permian Basin Reliability transmission project ($33 billion) which will traverse the state several times, and has a feature in the original bill to interconnect with other grids. This line is a 765 kV DC line, so I understand will not have to go by FERC regulations if this is to happen. The Southern Spirit line will go east and I don't know of an interconnect to the west.

All of this, as you say is quite concerning for the ratepayer. More transmission - more wind, solar and batteries and now more data centers. Hopefully for us, if our senators shape up, no more IRA. Not so for you. Our local officials are being convinced as we speak that batteries and solar will bring datacenters and will be able to power them. These companies will do anything to get local tax abatements.

I am concerned about the pace of growth and will it be able to sustain its self. I can already see that solar will be left on our doorstep as it fails as wind is already doing. But this is Texas - great for wind and solar, I would have thought Alberta not so good, and certainly bot a good fit for batteries at all.

I am not against growth, but I am against a frantic rush to supply an unproven product with no track record, the energy security our populations have come to expect and deserve, at an affordable cost.

We have to be very careful with the steps forward and I am afraid our politicians and utility commissions only see what they are being told will be best for them by large corporations promising growth and jobs, and only they will be the benefactors in the end.

I have been watching ERCOT for several years now and listened to their testimony before the senators last year. They sudden discovered that growth was going to double... like they didn't see that coming, but the mood was to put the senators in panic mode and create a crisis, which they did. If I could see this coming and they couldn't well we are in trouble!!!