So-called green hydrogen (H2) and ammonia (NH3) promise to sidestep China’s grip on lithium battery materials and revolutionize energy storage, but at what cost? These technologies, hyped as climate saviors, face crippling inefficiencies. Canada’s massive projects, like Spirit of Scotia and Nujio’qonik, backed by hefty subsidies, aim to flood Europe with green ammonia.

Yet, with production costs soaring and a seemingly unavoidable reliance on Chinese-controlled clean-tech supply chains, these ventures risk becoming taxpayer-funded black holes. As global Net Zero enthusiasm wanes, Canada’s bold bet on green hydrogen could inflate energy prices and deepen geopolitical vulnerabilities.

Green hydrogen, by definition produced via electrolysis (aka electrolytic hydrogen) using wind and solar PV (aka inverter based) electricity.

However, hydrogen’s low energy density, propensity to leak, and challenges in long-range transportation and long-term storage limit its practicality.

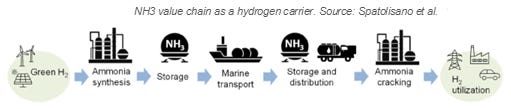

To address these issues, green ammonia has been identified as a potential hydrogen carrier.

Note that this is hardly new science or engineering.

International Energy Agency (IEA), ammonia production consumed 170 billion cubic meters (bcm) of natural gas as a source of hydrogen in 2023, representing about 4% of the global natural gas consumption.

Ammonia, synthesized by combining hydrogen with nitrogen in the traditional Haber-Bosch process, is easier to store and transport due to its higher density and stability, making it a candidate for applications like shipping fuel or industrial processes.

Despite these advantages, both green hydrogen and ammonia face significant thermodynamic inefficiencies.

The round-trip efficiency—encompassing H2 / NH3 production, storage, transportation, and conversion back to electricity—ranges from just 30 to 40% for hydrogen and 15% to 25% for ammonia.

This means that anywhere from 3 to 6 MWh of intermittent electricity from inverter based power generation resources are required to produce a mere 1 MWh of dispatchable electricity when using hydrogen or ammonia as a storage medium.

As electrolytic hydrogen and ammonia consume multiples times more energy than they produce, this suggests that their business model has energy production as a by-product and is not the path of an aspiring energy super power.

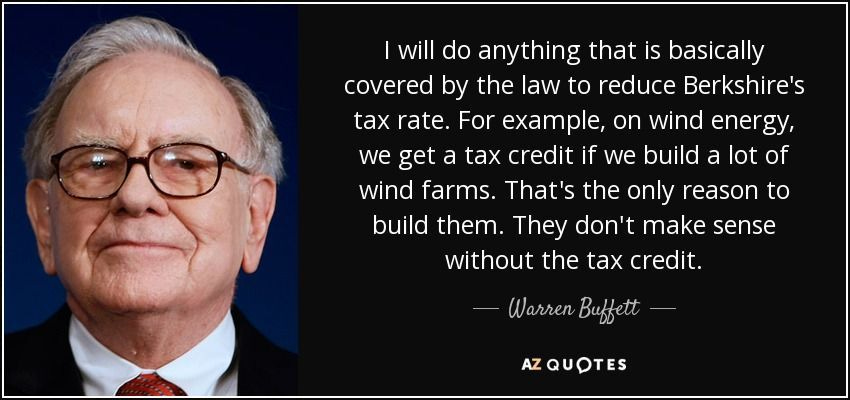

Clearly some other incentive is motivating the business case.

When we examine the United State’s Inflation Reduction Act (IRA) of 2022 implemented under the former Biden Administration, we see that it provided both a 30% investment tax credit (ITC) and a $3 USD per kg H2 production tax credit (PTC) for electrolytic hydrogen produced using wind and solar PV electricity.

This is a very significant source of revenue when we consider that the full in cost of production of electrolytic hydrogen from weather dependent inverter based power sources is $3 to $8 per kg depending on factors such as renewable electricity costs, electrolyzer capital expenditure (CAPEX), and capacity utilization.

It should come as no surprise that the US Federal Government paid wind and solar PV companies $31.4 billion in income tax rebates in 2024 and the 10-year cost of federal tax expenditures for wind and solar has increased 21-fold since 2015.

It is worth noting that the Trump Administration issued an executive order on July 7th 2025, calling to end the subsidy program from wind and solar PV in United States.

While neither EU or Canada were willing to compete with the IRA’s PTC, both did their best to provide similar ITCs and other supporting financial incentives.

For example, the governing federal Liberal Party of Canada offer PTCs upwards of 40% for up-front capital spent on this technology, as well as other supporting mechanisms (e.g., Clean Fuels Fund, Canada Growth Fund and Net Zero Accelerator Initiative).

When former PM Justin Trudeau infamously stated "there is no business case for Canadian LNG to Europe", he made vague reference to the trillion dollar "green hydrogen" investment plan for Atlantic Canada that would instead export its "green ammonia" to Europe.

Green Hydrogen International, whose board members include former McKinsey senior partner Andy Steinhubl, announced in 2022 their intentions to build 500 GW of offshore wind power, together with H2O electrolyzers, underground H2 storage caverns and ammonia synthesis plants.

Assuming 40% capacity factor for Atlantic Canada off-shore wind power and an electrolyzer availability of 90%, this would require approximately 200 GW of electrolzyers. Putting this into perspective, global H2O electrolyzer capacity is estimated by the IEA to be around 5 GW as of 2024.

The GHI’s Spirit of Scotia project alone is slated to be capable of producing 43 million tonnes of hydrogen - putting this into perspective, this is equivalent to approximately half of global hydrogen production on a yearly basis.

Yes, you heard that correct.

When we consider that such a facility would likely have a specific cost of $6.345 billion CAD per GW of electrolyzer capacity, it is clear that this project, if it reaches FID, will be built in GW phases over years if not decades.

Another Atlantic Canada project of the same nature is Project Nujio’qonik, which is a large-scale, wind-powered green hydrogen and ammonia production facility on the west coast of Newfoundland and Labrador. It aims to be Canada’s first commercial-scale green hydrogen/ammonia producer, leveraging the region’s world-class wind resources (over 11 GW potential).

The project includes up to 4 GW of onshore wind farms (two 1 GW farms in Port au Port and Anguille Mountains, with two additional 1 GW farms planned) to power electrolysis for producing approximately 280,000 tonnes of green hydrogen annually, convertible to 1.6 million tonnes of green ammonia for domestic and export markets, primarily to Europe.

The facility is located at the Port of Stephenville, which World Energy GH2 owns, enabling efficient global export.

Two expansion phases of equal scale could triple output, with additional wind turbines planned north and south. The estimated capital cost is ~$15 billion for the multi-phase project, targeting 210,000 tonnes of green hydrogen yearly (1.2 million tonnes of ammonia).

On April 9, 2024, the Newfoundland and Labrador government released the project from further environmental assessment after a 22-month evaluation, approving it with conditions under the provincial Environmental Assessment Act. The Environmental Impact Statement (EIS), prepared with Stantec, included over 30 baseline studies.

Likewise is noteworthy that the new Liberal Bill C-49, which received Royal Assent on October 3, 2024, effective in Nova Scotia on January 31, 2025, and Newfoundland and Labrador on June 2, 2025. It amends Atlantic Accord Acts to regulate offshore wind, renaming petroleum boards as Offshore Energy Regulators and acts to streamline investment in offshore wind projects.

Thus the regulatory framework is largely in place for projects like Spirit of Scotia and Project Nujio’qonik and it is expected that FID for the latter is imminent.

While Europe and United States are backing off of off-shore wind investments due to supply chain dependence on China, growing environmental concerns and costs, Canada appears to be willing to re-invent the wheel.

According to this January 2025 Nature publication, so-called green hydrogen projects can not survive without permanent carbon trading markets and taxpayer subsidies. According to this study, the projects in queue globally, if built, will require anywhere from US$0.8 – 2.6 trillion per year in such additional revenues aside from hydrogen, ammonia and electricity sales.

As of July 13, 2025, no binding off-take agreements for green hydrogen or ammonia from Atlantic Canada or Quebec projects are explicitly confirmed in available sources.

EverWind Fuels is the closest, with non-binding MoUs from 2022 and ongoing negotiations for binding agreements by late 2024, but no updates confirm finalization. Other projects (e.g., Bear Head, Nujio’qonik, Spirit of Scotia, Hy2gen) are in advanced planning but lack documented signed off-take contracts, focusing instead on local or European markets.

Fiscally minded Canadians should pay attention to this file over the next couple of years, as the capital stakes are immense for taxpayers and energy consumers alike.

Likewise, for those concerned about Canada’s growing dependence on and geopolitical risks associated with deeper economic ties with the People’s Republic of China, it is necessary to point out that 50% to 70% of global H2O electrolyzer, wind turbines and gearboxes, materials and fuel cell manufacturing capacity resides within its control.

And we come back to the basic question of "who pays?" Alberta, as the (current) economic engine of Canada could very well end up footing the bill for this fiasco, right?

Thanks for laying this out with such clarity, Joseph.